So You Lost Your Job? How To Apply for Health Insurance

Supporting our artist community is at the heart of what we do. Each day we’re going to be sharing some important tools, opportunities, and resources for artists on our blog. Follow along and reach out if you need additional support.

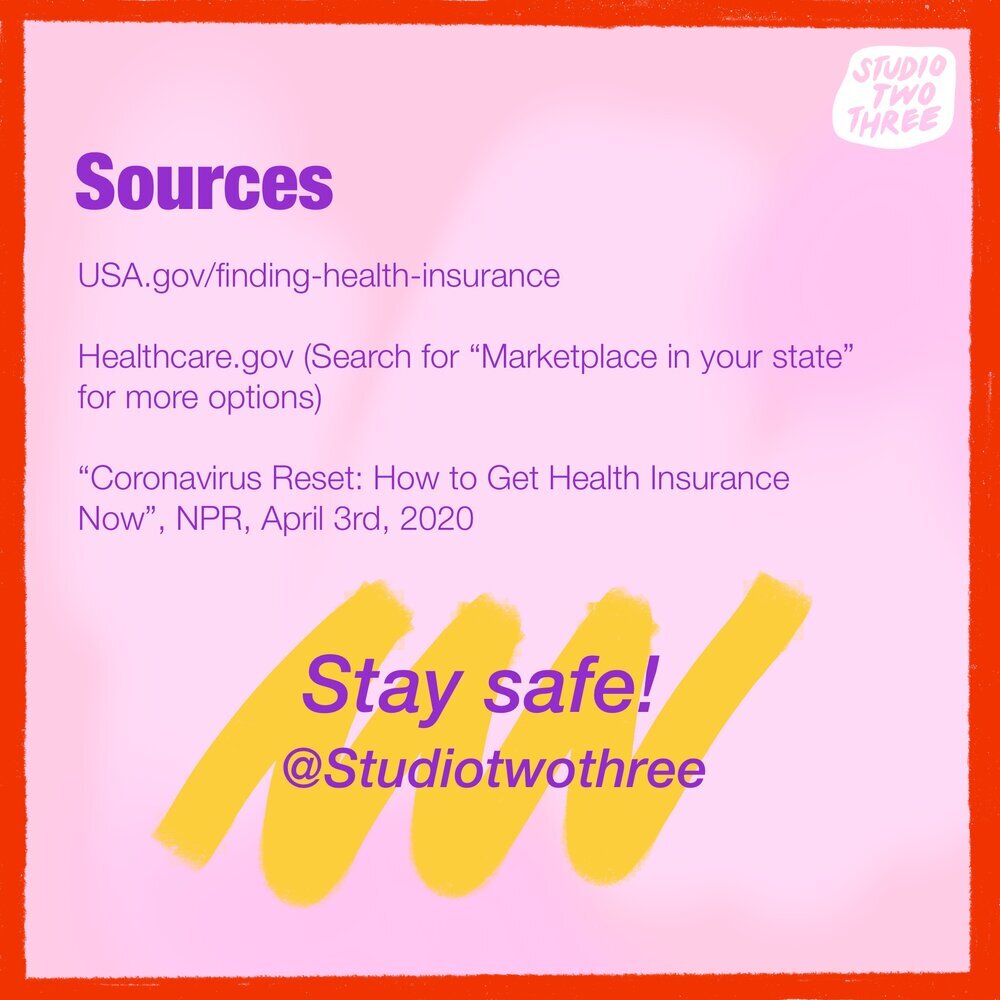

Today we’re going to talk about how to apply for health insurance, and what options are available to you.

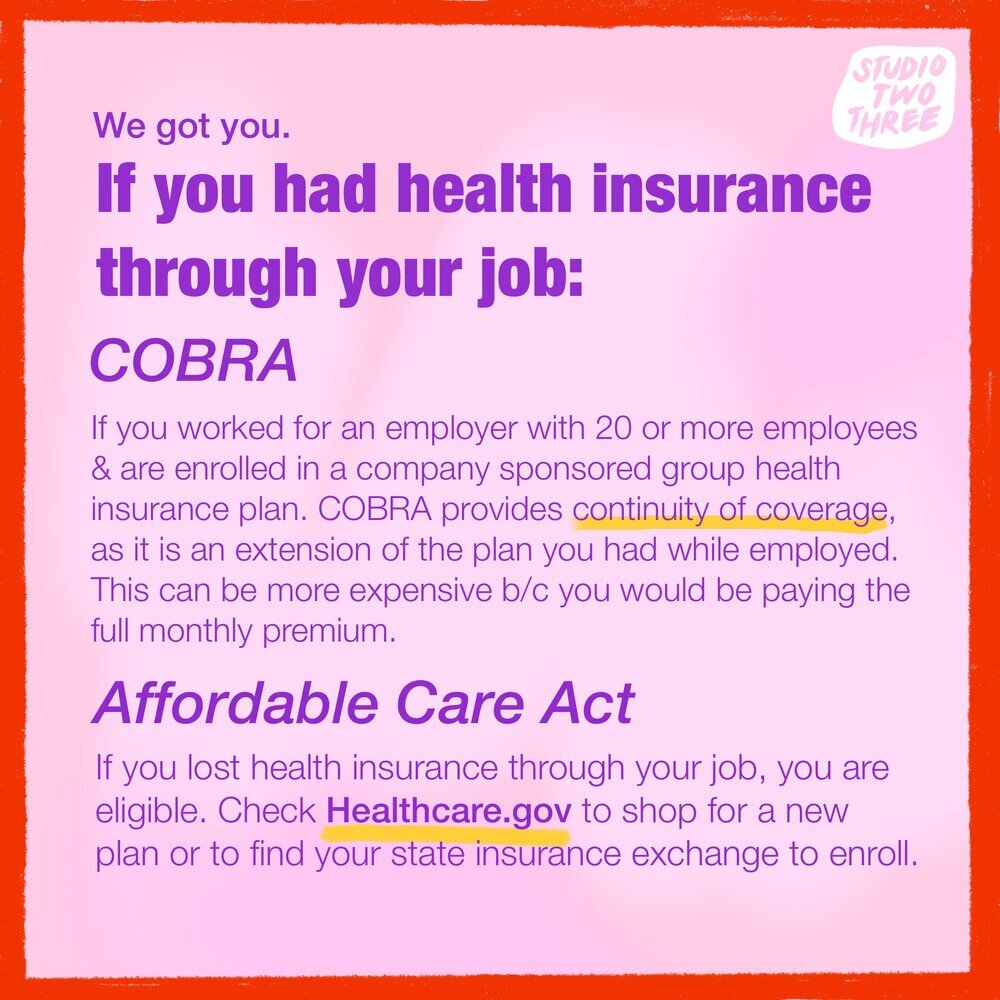

If you had health insurance through your job:

You can check your eligibility for the federal Consolidated Omnibus Budget Reconciliation Act (COBRA) if you worked for an employer with 20 employees or more and are enrolled in a company-sponsored group health insurance plan. COBRA provides continuity of coverage, as it is an extension of the plan you had while employed. This option can be expensive because you would have to pay the full monthly premium.

Next, check the Affordable Care Act. If you lost health insurance through your job, you are eligible, and can check healthcare.gov to shop for a new plan or find your state’s medicaid offering to enroll in a healthcare plan.

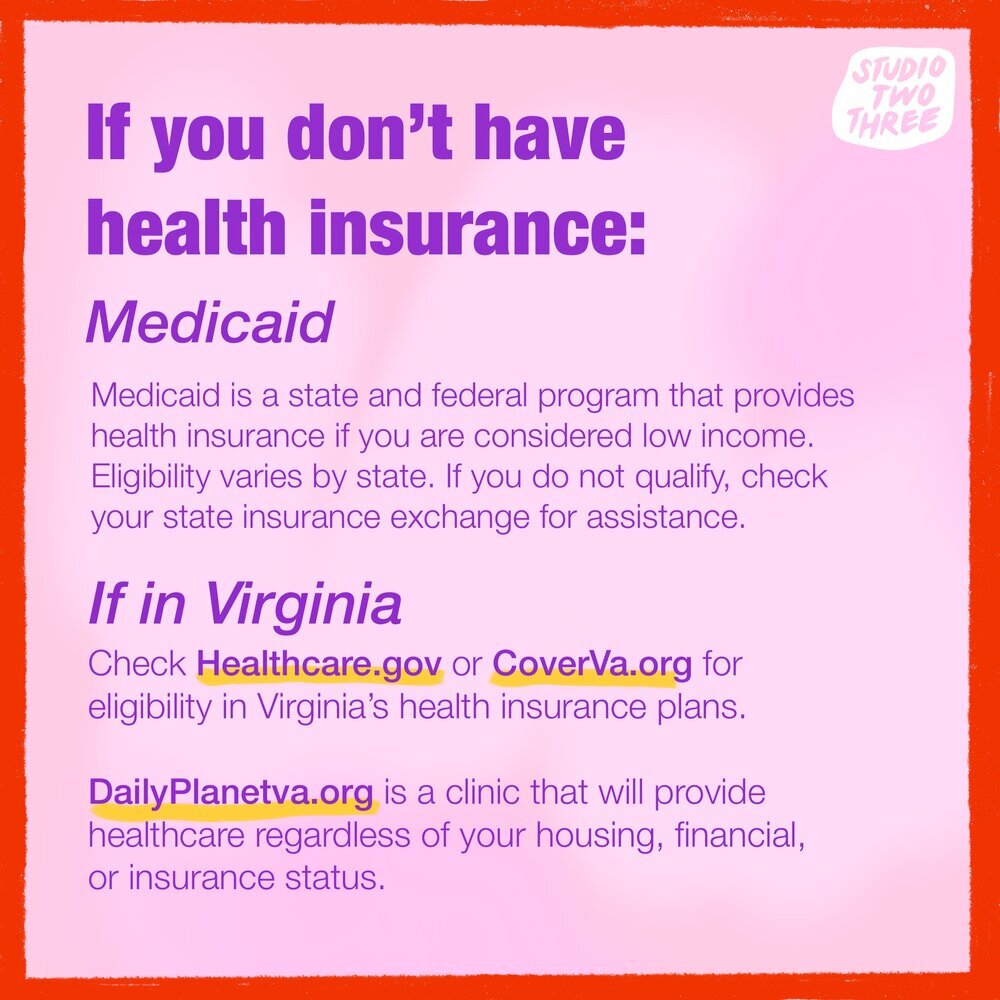

If you don’t have health insurance:

Medicaid would be the first place to check. Medicaid is a state and federal program that provides health insurance if you are considered “low-income”. Eligibility varies by state. If you do not qualify, check your state insurance exchange for assistance.

If you are in Virginia, check heathcare.gov or CoverVa.org for eligibility in Virginia’s health insurance plans.

Daily Planet VA is a clinic that will provide healthcare regardless of your housing, financial, or insurance status.

If your kids need coverage:

If you can’t afford a health plan for adults in your family, there are still options for your kids. Check InsureKidsNow.gov to find if your children are eligible.

If you are pregnant:

You are covered by Medicaid and CHIP. Your eligibility and benefits vary by state.

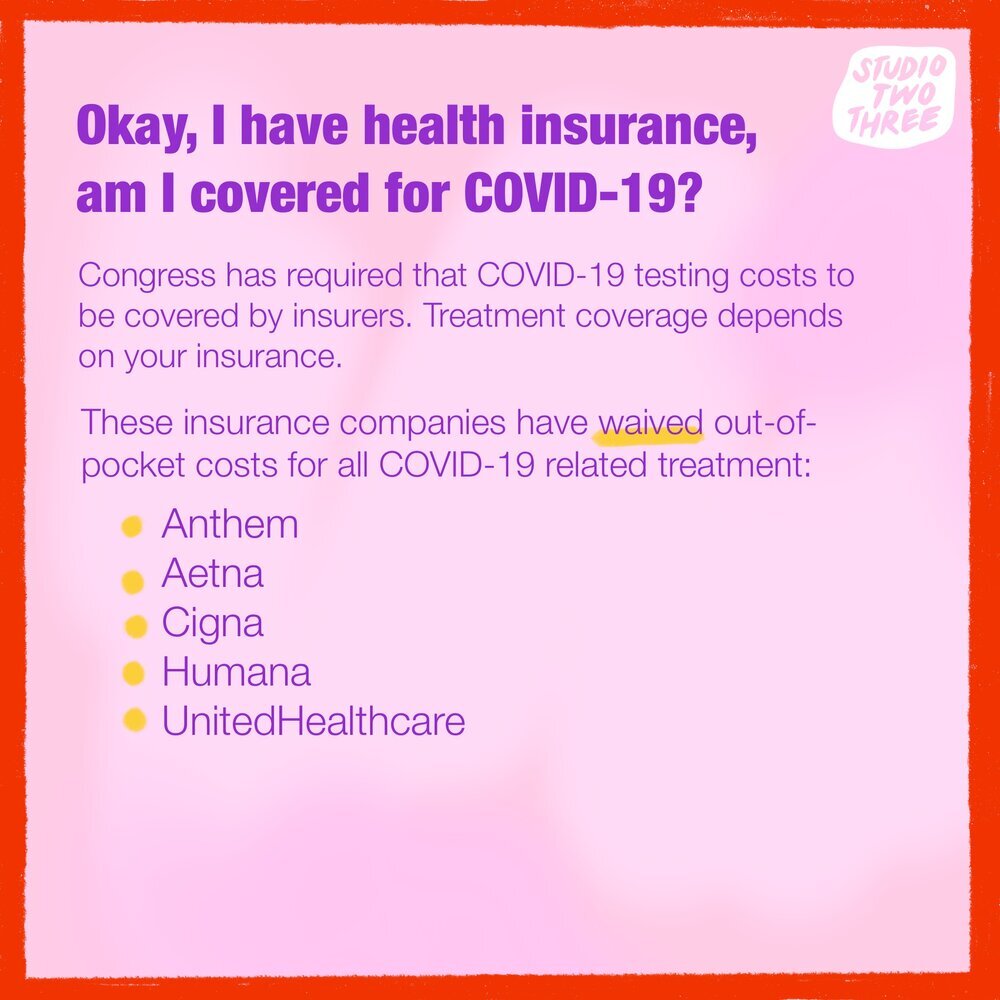

Okay, I am insured, what’s covered during this pandemic?

Congress has required that COVID-19 testing costs to be covered by insurers.

For treatment so far, insurance companies Anthem, Aetna, Cigna, Humana, and UnitedHealthcare have waived out of pocket costs for all COVID-19 related treatment.

If you do receive a COVID-19 Treatment bill:

Call your hospital, doctor, or insurance company and try to negotiate a lower bill. If they won’t budge, ask if they can offer a payment plan, or forgive the debt as part of a charity care program. (This can be applied to any bill you receive from a hospital.)