How to Apply for Unemployment

Supporting our artist community is at the heart of what we do. Each day we’re going to be sharing some important tools, opportunities, and resources for artists on our blog. Follow along and reach out if you need additional support.

Today we’re going to talk about how to file for unemployment, and how to ensure you are receiving all monetary benefits you qualify for.

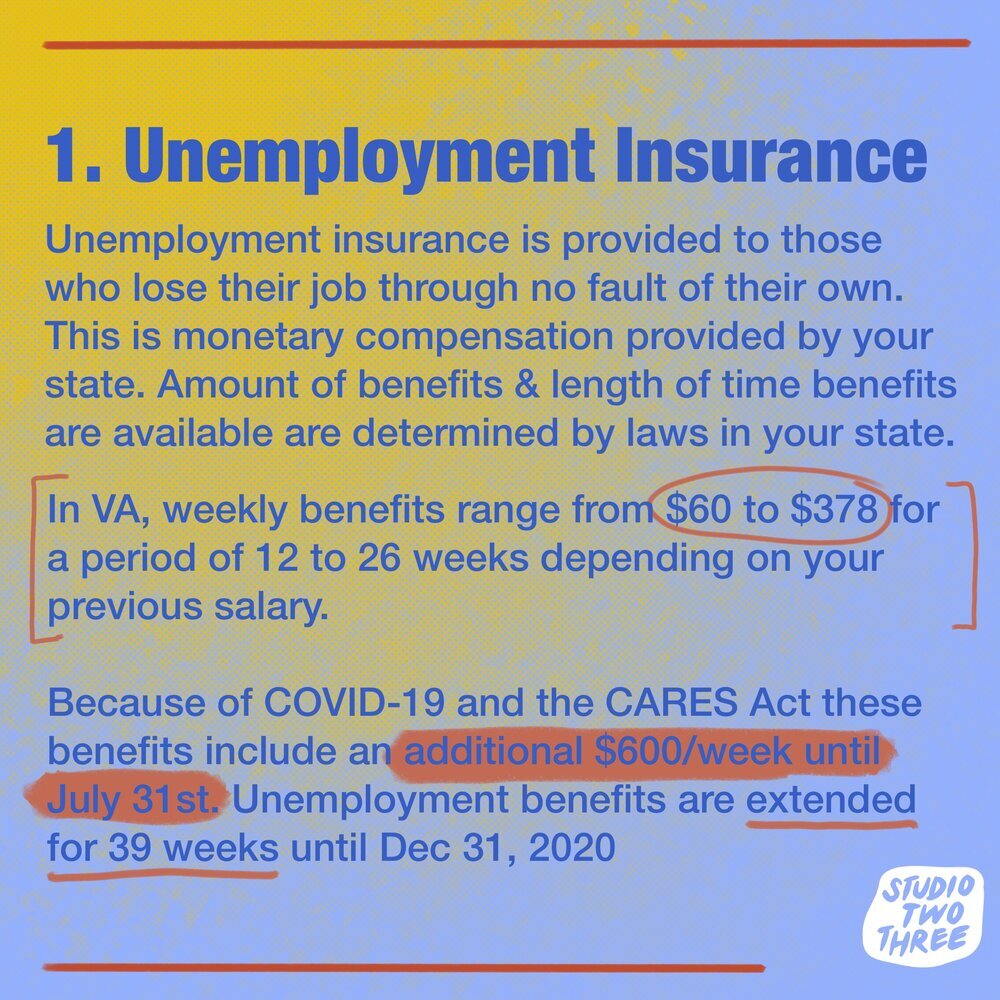

WHAT IS UNEMPLOYMENT INSURANCE?

Unemployment insurance is provided to those who lose their job through no fault of their own. This is monetary compensation provided by your state. Amount of benefits and length of time benefits are available are determined by laws in your state.

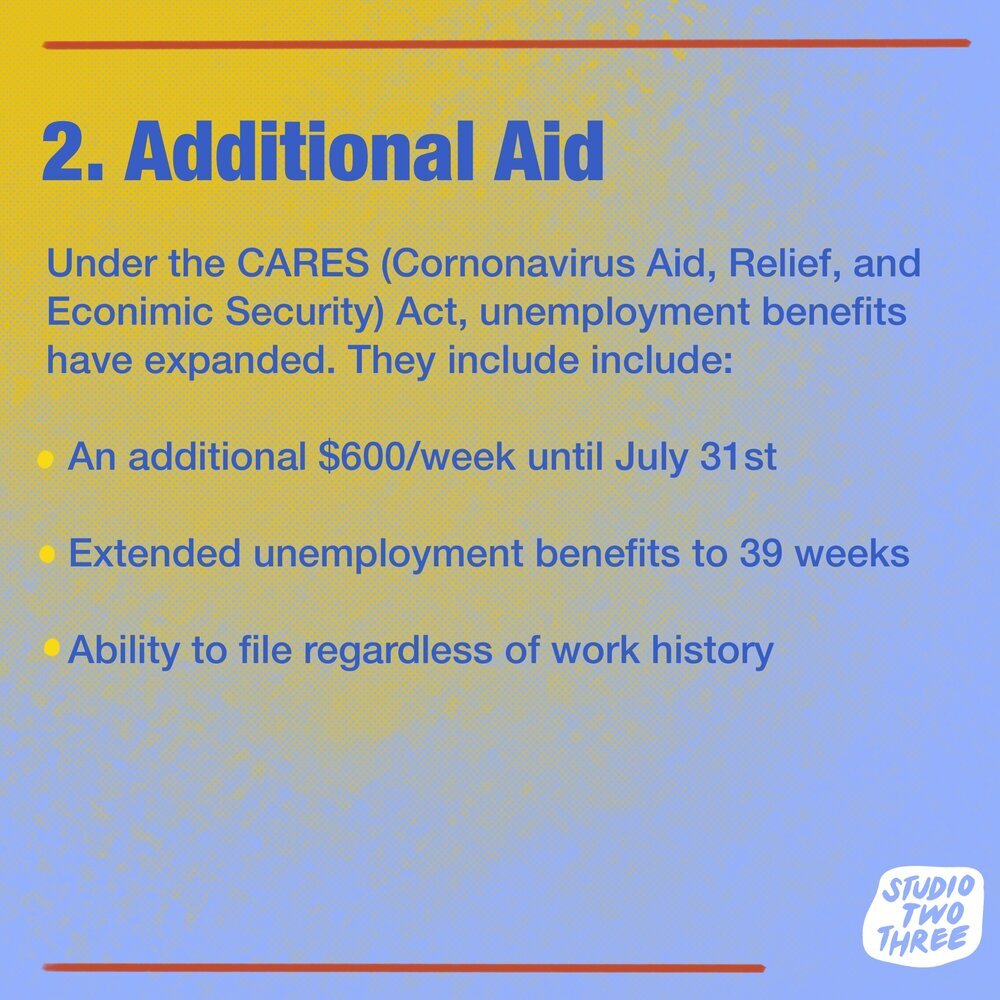

WHAT ARE ADDITIONAL BENEFITS AVAILABLE DUE TO THE PANDEMIC?

For example, in Virginia, normal weekly benefits range from $60 to $378 for a period of 12 to 26 weeks depending on your previous salary. Now, because of COVID-19 and the CARES (Coronavirus Aid, Relief, and Economic Security) Act, these benefits include an additional $600/week until July 31st. Unemployment benefits are extended for 39 weeks until Dec 31, 2020.

Additionally, the CARES Act allows those who are self employed, part-time workers, and those who had just started a new job to be eligible for unemployment benefits. The weekly $600 payment also applies.

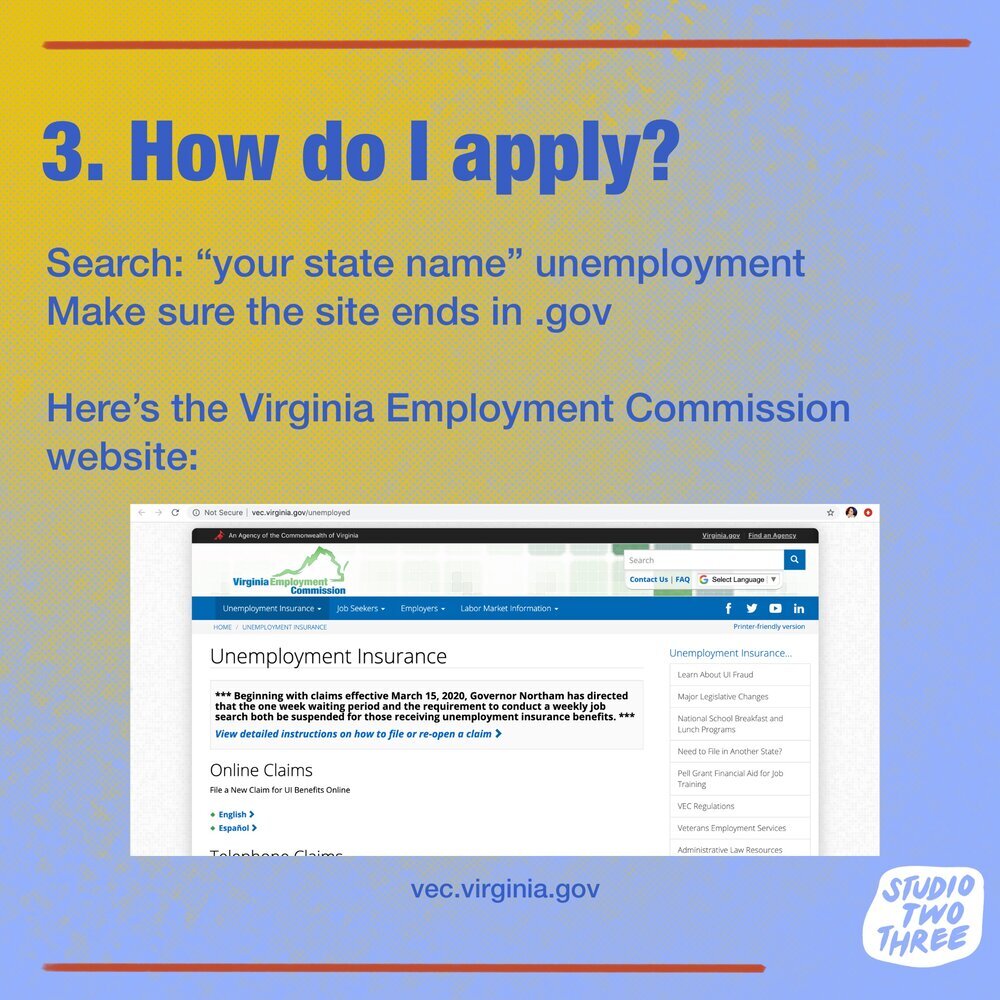

HOW DO I APPLY FOR UNEMPLOYMENT?

To apply, search “your state name” unemployment in Google, and make sure the site ends with “.gov”. If you are in Virginia, you can apply at vec.virginia.gov. You will need your social security number, employer name, address, and number, as well as a method of payment (including your routing number and account number if you are choosing direct deposit.

**REMEMBER TO FILE WEEKLY TO CONTINUE RECEIVING BENEFITS. WHEN WILL I RECEIVE PAYMENTS?

UNEMPLOYMENT CHECKS:

$600 weekly payments provided for by the CARES Act will be provided once states have built a system for distribution, which they are working on now. Check vec.virginia.gov, or your state’s unemployment insurance website for updates.

STIMULUS CHECKS:

The IRS will begin to send out stimulus payments starting April 9th, beginning with low income workers.

If you have filed a 2019 tax return:

The IRS will use this information to calculate the payment amount. The payment will be deposited into the same banking account reflected on the return filed.If you still need to file your tax return:

Economic payments will be available throughout 2020. You will still be eligible to receive payments as long as you file before the July 15th deadline.What if the IRS does not have my direct deposit information?

In the coming weeks, Treasury plans to develop a web-based portal for individuals to provide the IRS with their banking info online.

You can find more info regarding stimulus payments here.

For resources in Richmond, check out our COVID-19 Resources Page