Stimulus Check FAQs

Supporting our artist community is at the heart of what we do. Each day we’re going to be sharing some important tools, opportunities, and resources for artists on our blog. Follow along and reach out if you need additional support.

Today we’re going to share more information and resources to support your community.

Your stimulus payments are yours to use and to keep. It is easy to feel confused with all the misinformation out there about whether or not you have to pay the stimulus check back next year or if it is taxable. Let’s clear this up.

Will I have to pay it back?

You DO NOT have to pay your stimulus checks next year. Your 2020 tax return and any refund you are due when you file next year WILL NOT be affected by the check you are getting now.

Is it taxable income?

No. The stimulus checks are nontaxable and will not be counted as part of your 2020 income.

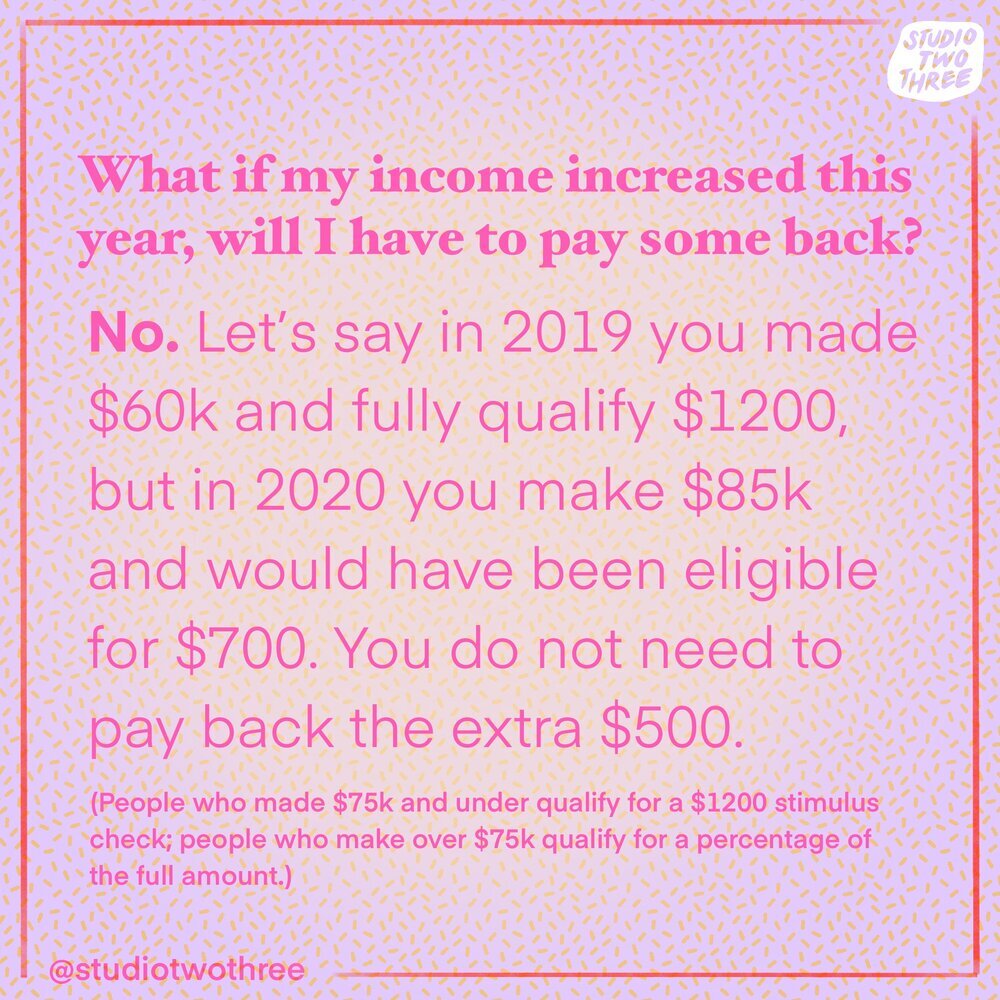

What if my income increased this year, will I have to pay an amount back?

No. Let’s say you get a raise this year and in 2019 you made $60,000 and qualify for the full $1200 stimulus check. In 2020 you end up making $90,000 which means you are technically only eligible for $600. You do not need to pay back the additional $600.

(People who made $75k and under qualify for a $1200 check; people who make over $75k qualify for a percentage of the full amount)

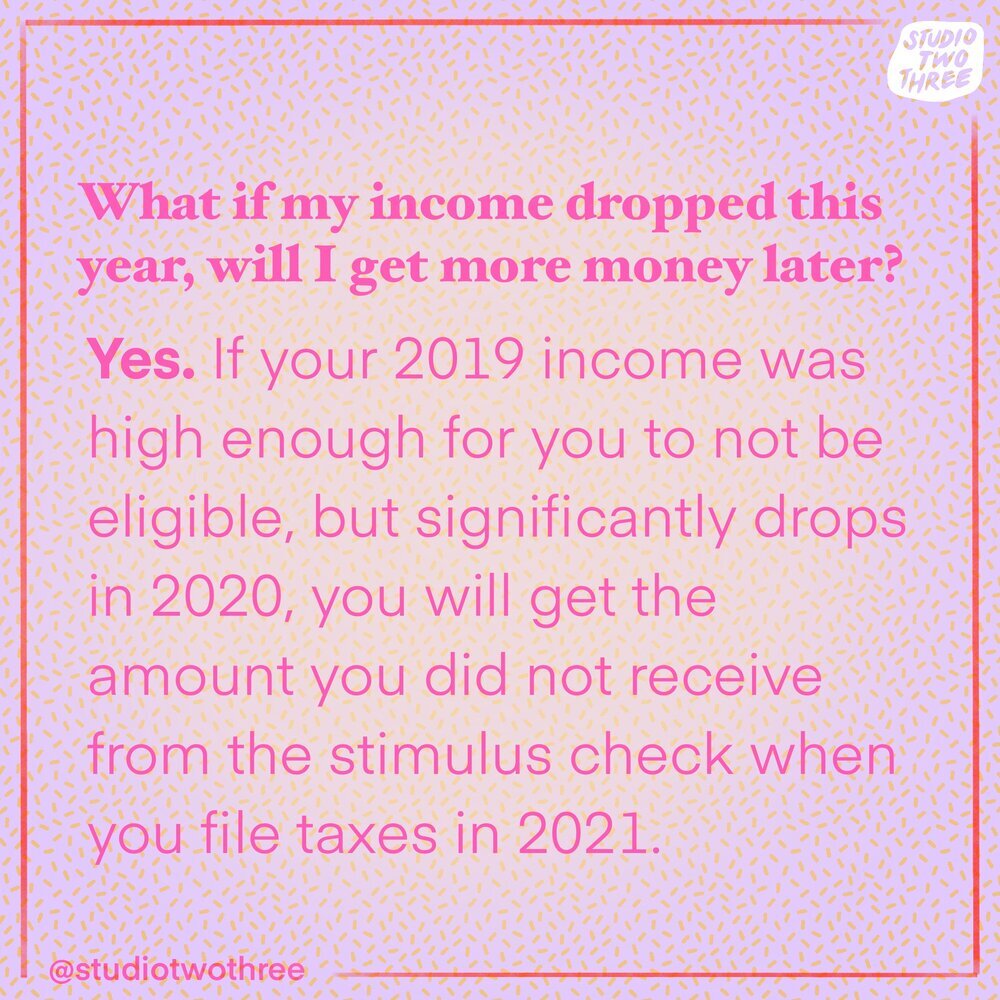

What if my income drops, do I get more?

Yes. If your 2019 income was high enough to put you past or in a range of eligibility, and then your income significantly drops in 2020, you will get the amount you did not receive from the stimulus check when you file taxes in 2021.

NO ONE WILL OWE THE IRS EXTRA MONEY NEXT YEAR BECAUSE OF THE STIMULUS CHECK THEY GET NOW.

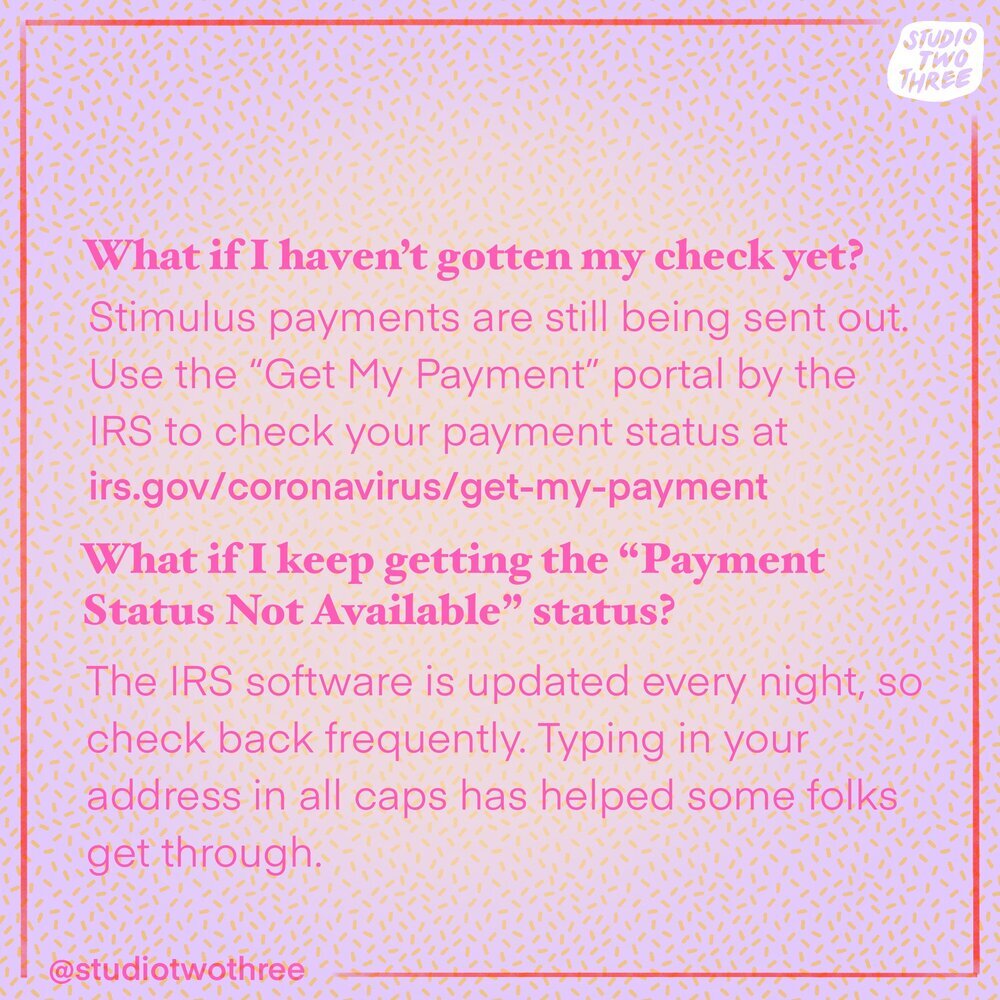

What if I havent gotten my check yet?

Stimulus payments are still being sent out. If you are eligible and have not received one yet, the “Get My Payment” portal tool by the IRS can help check your payment status.

What if I keep getting a “Payment Status Not Available” status?

The IRS is updating its software overnight daily, so check frequently. Typing in your address in all caps has helped some folks get through.

What if I get locked out?

There could be many reasons, but it is probably a security feature. Try again the next day after the IRS updates their site.

What if the payment was sent to the wrong address or bank account?

The IRS will send you a letter within 15 days of sending your stimulus payment. The letter will include instructions on how to contact the IRS regarding this issue.